About Us

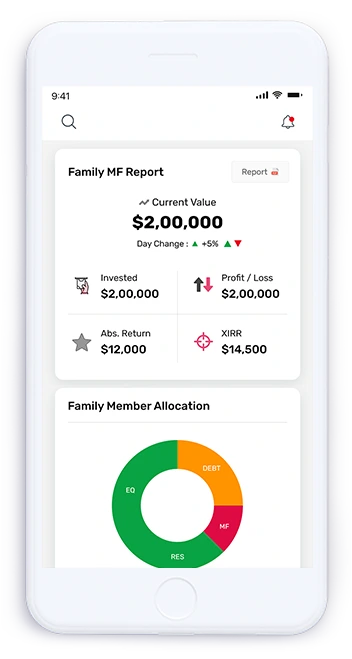

Mittal Associate is the company which is handling complete financial planning with CFP certification . Our core team is having more than 75 years of experience in money management . we started 2 decades ago and we are having more than 1000 happy clients across the globe .

About us